A Budget That Leaves You Wanting: Slow Relief, Modest Reforms, and Unmet Expectations

Last year, when we sat down with Parramatta’s Federal Labor MP, Dr Andrew Charlton, to discuss his book Australia’s Pivot to India, we came across a chart in his book that we mentally bookmarked—knowing it would come in handy one day.

That day is today, as we share our thoughts on Australia’s latest Federal Budget for 2025–26.

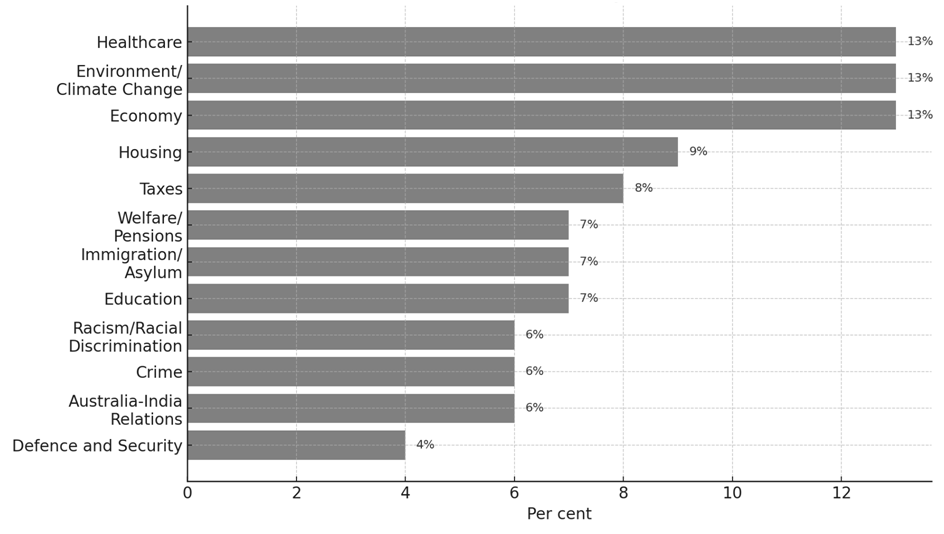

Using the chart as a general guide to the priorities of South Asians living in Australia, we’ll reflect on how the latest budget addresses these concerns. According to the chart, the top issues for the community include healthcare, climate change, housing, and taxes.

Given that the chart dates back to 2022, we suspect that climate change may have slipped in priority—overtaken by more immediate concerns like healthcare, housing, and taxes, particularly after the recent years of relentless cost-of-living pressures.

As such, we’ll limit our discussion in this article to those three key issues: healthcare, housing, and taxes.

Figure: Top voter issues in Australia’s 2022 election for Indian Australians

Note: Australia’s Pivot to India, Andrew Charlton, Survey of 617 registered Australian voters surveyed

Healthcare

Given that healthcare is a top-of-mind issue for the South Asian community, the latest federal budget is a big positive—and gets our thumbs up!

However, what gets our thumbs down is the timeline. The bulk billing changes are set to take until 2030 to be fully implemented—far too long. That means relief for households is not immediate. Let’s hope Peter Dutton’s Coalition offers a stronger response to Labor’s healthcare budget and brings the implementation forward. From our perspective, that would be a vote winner.

In contrast, European nations such as Germany, France, and the Scandinavian countries consistently provide fully subsidized universal healthcare. Australia is moving in that direction, but the pace remains frustratingly slow.

Key Healthcare Measures

- Significant Medicare Expansion ($7.9 billion)

- Encourages more bulk billing (aiming for 9 out of 10 GP visits by 2030).

- Reduces immediate out-of-pocket costs for patients, improving access and affordability, particularly beneficial for low-income households.

- Cheaper Medicines (PBS Co-payment Reduction)

- Co-payments reduced from $31.60 to $25 per prescription, improving medication affordability and accessibility.

- Direct benefit for Australians, particularly the elderly and chronically ill.

- Aged Care Funding Boost

- Improving wages for aged-care workers ($2.6 billion) likely to enhance care quality by attracting more qualified workers.

Housing

Australia’s housing is set to remain unaffordable and expensive—that is the bottom line of this budget.

There is nothing in the budget to reform local planning laws, which are essential to unlocking the supply of additional housing. Limited supply is Australia’s core housing issue, and increasing supply requires cutting red tape in development approvals and enabling higher urban density. This is not happening.

The support provided for first-home buyers and renters appears designed more to maintain the status quo than to meaningfully shift the affordability equation. These measures provide temporary relief but do little to address the structural barriers driving high prices.

Key Housing Measures

- Expanded Help to Buy: Offers lower deposits and smaller mortgages through shared equity.

- Housing Australia Future Fund: Delivering around 18,000 new social and affordable homes.

- Commonwealth Rent Assistance: 45% increase providing relief for around 1 million households.

- Banning Foreign Buyers: Temporarily reducing competition for existing housing stock.

- Construction Apprenticeship Incentives: Up to $10,000 for apprentices, encouraging workforce growth.

Tax Cuts

The tax cuts offered are too little, too late. In keeping with the recurring theme of delayed gratification in this budget, the tax cuts—when contrasted against the record increases in mortgage interest rates, skyrocketing insurance costs, rising energy bills, and more—fall short. An annual tax saving of just $268 by 30 June 2027 is, from our perspective, a non-starter.

We will be watching the Coalition’s response to the tax cuts with great interest.

Struggling businesses in Australia are notably absent from any meaningful tax relief. Contrast this with what is set to happen in the United States under President Trump: in his first term, Trump cut business taxes from 35% to 21% and doubled the standard deduction for individuals. In his proposed second term, he is set to cut taxes even further.

By contrast, Australian businesses continue to face a 30% corporate tax rate (for large companies) and 25% for small businesses. Given that business is the engine of employment and wage growth, withholding meaningful relief puts Australia at risk of falling behind. If we don’t support businesses and remain competitive with other advanced economies, we risk becoming increasingly reliant on government-funded sectors like healthcare and aged care to generate employment—as has been the case in recent years.

Key Tax Measures

- Personal Income Tax Cuts

- Gradual rate reductions for low-to-middle-income earners:

- From 16% to 15% in July 2026

- From 15% to 14% in July 2027

- Benefit: Approx. $268 in annual savings in 2026–27, increasing to $536 by 2027–28 for an average-income earner (around $79,000/year)

- Gradual rate reductions for low-to-middle-income earners:

- Reduced Medicare Levy Burden

- Increased Medicare levy thresholds offer relief for lower-income Australians.

- Impact: Protects the most vulnerable households from tax increases due to inflation.

- Student Debt Relief

- Immediate 20% cut to HELP (student loan) balances for around 3 million Australians.

- Impact: Improves financial flexibility and acts as indirect tax relief by reducing compulsory repayments.

Final Thoughts

While the budget addresses key concerns like healthcare, housing, and taxes, it leaves much to be desired in terms of immediacy and impact. The slow implementation of bulk billing, the lack of meaningful housing supply reforms, and modest tax cuts make this a budget that leaves Australians—particularly South Asians—wanting more.

Winners and Losers of the 2025 Budget: Who Gains, Who Misses Out?

🏆Winners

1. Low-to-Middle Income Households

- Tax Cuts:

- From 1 July 2026, the 16% income tax rate drops to 15%, and further to 14% from July 2027.

- A person earning $79,000/year will save $268 in 2026–27, and $536/year from 2027–28.

- Example: A family with two working adults earning $70k and $50k will save around $800–900 annually by 2027.

- Energy Bill Relief:

- $150 electricity rebate for every household until December 2025.

- Small businesses get $325 rebate — useful for migrant-run takeaways, grocers, and salons.

- Healthcare Access:

- Expansion of bulk billing, with a $7.9 billion investment.

- 9 in 10 GP visits to be free by 2030 — helpful for South Asian families managing chronic conditions like diabetes and hypertension.

- PBS Medicine Cost Cut:

- Co-payments drop from $31.60 to $25 from January 2026.

- Families managing chronic conditions (e.g., diabetes, cholesterol) save $300–$500+ a year.

2. Students and Graduates

- 20% Student Debt Forgiveness:

- Applies immediately to around 3 million Australians.

- Example: A graduate with $25,000 in HELP debt will have $5,000 wiped off this year.

- Fairer Repayment Thresholds:

- Loan repayment starts at $67,000 (was $54,435), leaving more money in young professionals’ pockets.

3. Women

- $793 million toward women’s health (contraceptives, endometriosis, menopause support).

- Wage support for female-dominated sectors:

- Aged care workers: $2.6 billion for wage increases.

- Early childhood workers: $3.6 billion funding for higher wages and job security.

4. Housing Support

- Help to Buy Scheme:

- Government takes up to 40% equity, reducing deposit/mortgage requirements.

- Example: A $700,000 apartment purchase needs only $35,000 deposit instead of $70,000.

- 18,000 new social/affordable homes through the Housing Australia Future Fund.

- Commonwealth Rent Assistance increase by 45%, helping around 1 million households.

5. Multicultural Communities

- Workforce Support:

- Many South Asian Australians work in aged care, transport, and disability services — all receive budget boosts through better pay and training incentives.

- Construction apprenticeship incentive: Up to $10,000 per person, useful for migrants in trades.

❌ Losers

1. Small Business (Broadly)

- No change in corporate tax rates:

- Large businesses continue to pay 30%, small businesses 25%.

- No new deductions or tax offsets — just modest energy rebates.

- Example: A South Asian family-owned café with 5 employees will get a $325 energy rebate, but no payroll tax relief or rent assistance.

2. High-Cost City Homebuyers

- No reform of planning laws or local zoning.

- No action to streamline development approvals.

- Limited measures to address the housing supply bottleneck, especially in cities like Sydney and Melbourne.

3. Temporary Migrants & International Students

- Most budget measures target citizens or permanent residents.

- International students and temporary workers, who make up a large portion of South Asian migrants, see no direct benefits from tax cuts or energy relief.

4. Climate Advocates

- While $22.7 billion is allocated to green energy and critical minerals over the next decade:

- Budget lacks short-term acceleration of emissions reduction.

- No new incentives for households to adopt solar or EVs in 2025–26.

5. Migrant Communities

- No direct funding for multilingual or culturally safe services in healthcare or aged care.

- No mention of migration reform, faster visa processing, or settlement support.

- No new support for ethnic small business resilience, despite inflation pressures and cost-of-living impacts.